Challenge:

Changes for the Travel Industry in the Search Marketing Landscape

Since Google rolled out Google Bookings in 2019, it has quickly surpassed all other top travel and booking agencies out there.

In a Forbes article, TripAdvisor management said, “Our most significant challenge remains Google pushing its own hotel products in search and siphoning off quality traffic that would otherwise find TripAdvisor.”**

This statement only encompasses the largest SERP disruption to the travel industry and does not include any other SERP feature changes adding to the difficulty of maintaining (and re-capturing) top ranking positions, or the natural occurrences that can happen to destinations to change the desirability of future travel.

A statement from the same article touches on the mass revenue decline the travel industry has been undergoing since the launch of Google bookings, “Its travel site already brings in more revenue than any other travel site. Google earned roughly $18 billion from online travel agents last year. Revenues for the largest online travel agent, Booking.com, were $14.5 billion.”**

Solution:

Deep Analysis of Destination Interest & Search Behavior

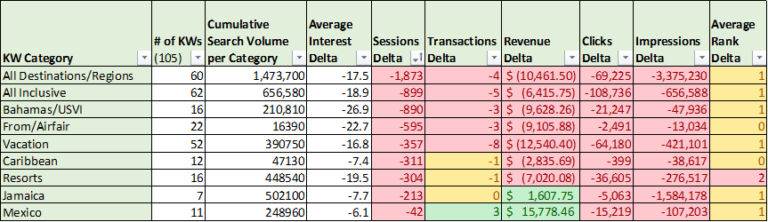

In order to answer the ultimate question of ‘are people still interesting in these destinations,’ we developed a report to delve into destination queries from the previous 16 months.

We utilized Excel to consolidate data from tools like Google Analytics, Keyword Planner, Trends and Search Console to identify top destination keywords and how important KPIs have trended. Once this information was analyzed, our client was able to shift priorities as needed for ads, promotions and incentives in order to build up more revenue and sessions.

Methodology

Tools Used: Google Keyword Planner, Analytics, Search Console, Trends

We pulled all KPIs for YoY time groups: previous 4 months and the congruent 4 months last year. (Currently, there is no way to attain 24 months of data from Google Search Console.)

o Monthly Search Volume (not eligible for YoY comparison)

o Average Rank

o Clicks

o Impressions

o Sessions

o Transactions

o Revenue

o Interest Level

Next, we attained deltas for all applicable KPIs by keyword, then we identified top performing keywords of each individual KPI. This is essential to ensure there are no missing keywords without data from each separate tool. Since there are an overabundance of keywords, we then bucketed keywords into destinations, resort types, vacation types, package types, etc. in order to ascertain action items.

Finally, we created a focused dashboard based on designated buckets and their KPI deltas to identify where the biggest changes have occurred and where.

Results & Outcomes

While ranks were steady, destination specific keywords took the biggest hit across all KPIs as these are keywords most impacted by Google bookings, as well as susceptible to natural disasters contributing unavoidable lowered booking rates.

Some data points to note:

- Mexico was successful in maintaining rank and an increase of revenue.

- Impressions took an enormous hit across all types of keywords. ‘Jamaica’ lost about 1,590,000 impressions and ‘Punta Cana’ lost about 1,049,000.

- Of destinations, Bahamas and US Virgin Island keywords saw the largest KPI hits with only 16 keywords showing a decline of 890 sessions and about 21,250 clicks.

Ultimately, we found that while destination specific keywords were losing some interest from the public, most losses could be contributed to a combination of the changing SERP landscape, and especially from Google bookings getting to potential customers before our clients’ website populated in the SERPs, not to mention the increasingly competitive travel industry landscape. We can make this assumption due to the mediocre loss in interest in certain destinations while sessions, clicks and impressions take substantial YoY dives.

Using this data, our client was able to adjust campaigns and projects across online platforms to accommodate for the changing interest levels of travelers by destination and package type. Our organic strategy was able to remain consistent with maintaining proper optimizations for all destinations and a concentration on SERP feature enhancements by incorporating rich snippets where useful.

*Note: This case study was performed pre-COVID-19.

**Quotes from How Google has Become the Biggest Travel Company by Stephen McBride https://www.forbes.com/sites/stephenmcbride1/2019/12/06/how-google-has-become-the-biggest-travel-company/#5118a08b4e09

Ready to Discover Your Own Path to Success?